- April 16, 2024

- Posted by: admin

- Category: Bookkeeping

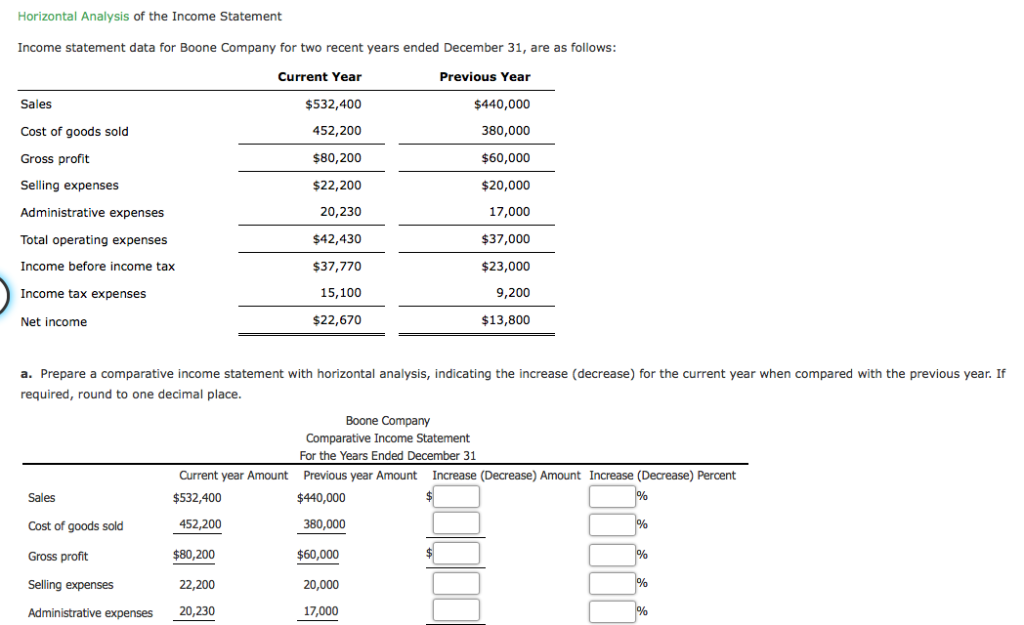

Horizontal analysis can help you identify trends in your data using your financial statements. Using Excel or Google Sheets is a great way to carry out a horizontal analysis of financial statements, especially if you use a pre-made template. If you use Layer, you can even automate parts of this process, including the control of data flows, calculations, and sharing the results. Accountants, investors, and business owners regularly review income statements to understand how well a business is doing in relation to its expected future performance and use that understanding to adjust their actions.

The Income Statement vs. the Balance Sheet

- In the above example, some of the expenses were increasing at a much faster rate than the revenue resulting in a reduction in net income.

- Vertical and horizontal analyses are both tools for financial statement analysis, but they differ in purpose.

- One should ideally take three or more accounting periods/years to identify trends and how a company is performing from one year/accounting period to the next year/accounting period.

- Horizontal analysis is valuable because analysts assess past performance along with the company’s current financial position or growth.

- It reflects the company’s profitability after accounting for all expenses, taxes, and other deductions.

It depends on the choice of the base year and the chosen accounting periods on which the analysis starts. In analyzing the income statements of a retail company, an analyst notices steady annual growth in revenue over the past five years. By performing a horizontal analysis, the analyst calculates year-over-year revenue growth rates, observing a consistent upward trend. However, the analyst also finds that the cost of goods sold the 12 best free invoice templates for designers (COGS) has been growing at a slightly faster rate than revenue. This trend raises a concern that rising production or supply costs may be compressing profit margins, prompting the analyst to recommend strategies for optimizing inventory or renegotiating supplier contracts. For example, if a company’s revenue was $1 million in 2019 and $1.2 million in 2020, then the horizontal analysis would show a 20% increase in revenue.

Horizontal and Vertical Analysis

Horizontal analysis serves as a powerful tool in financial decision-making, providing valuable insights that can guide strategic planning, investment decisions, and operational improvements. For instance, by identifying trends in revenue and expenses, management can make more informed decisions about resource allocation. If the analysis reveals consistent revenue growth, the company might decide to invest in expanding its operations or entering new markets. Conversely, if the analysis shows rising expenses without a corresponding increase in revenue, management might focus on cost-control measures to improve profitability. External factors also play a significant role in interpreting horizontal analysis results.

Great! The Financial Professional Will Get Back To You Soon.

From 2021 to 2020, we’ll take the comparison year (2021) and subtract the corresponding amount recorded in the base year (2020). In order to express the decimal amount in percentage form, the final step is to multiply the result by 100. The findings of common size analysis as compiled in the preliminary stages of due diligence are critical. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

Step 1: Gather Financial Information

Horizontal analysis makes it easy to detect these changes and compare growth rates and profitability with other companies in the industry. This method of analysis makes it easy for the financial statement user to spot patterns and trends over the years. Learning how to read and understand an income statement can enable you to make more informed decisions about a company, whether it’s your own, your employer, or a potential investment. While the definition of an income statement may remind you of a balance sheet, the two documents are designed for different uses. An income statement tallies income and expenses; a balance sheet, on the other hand, records assets, liabilities, and equity.

It doesn’t account for external factors or industry changes that may impact financial results. Also, horizontal analysis alone may not provide a comprehensive understanding of a company’s financial health and requires additional analysis and context. Through horizontal analysis of financial statements, you would be able to see two actual data for consecutive years and would be able to compare every item.

Obviously financial statements for at least two accounting periods are required, however, using a larger number of accounting periods can make it easier to identify trends within the financial data. Once you have your company’s values for the variables of interest, you need to find those of similar companies in your industry for the selected time periods. Sometimes you may find horizontal analysis reports, saving you the calculations, but you can always calculate the percentage change yourself using publicly available financial data.

This type of analysis enables analysts to assess relative changes in different line items over time and project them into the future. In studying ” Analyzing Income Statements ” for the CFA Exam, you should learn to understand the core components of an income statement, including revenue, cost of goods sold (COGS), operating expenses, and net income. Analyze how these elements reflect a company’s profitability, efficiency, and growth potential. Evaluate the principles behind ratios such as gross profit margin, operating margin, and net profit margin, which help assess financial performance. Additionally, explore how vertical and horizontal analyses provide insights into trends and expense structures, and apply your understanding to interpret income statement data in CFA-style scenarios and practice questions. Trend analysis extends beyond simple period-to-period comparisons by examining data over a longer timeframe to identify consistent patterns or trends.